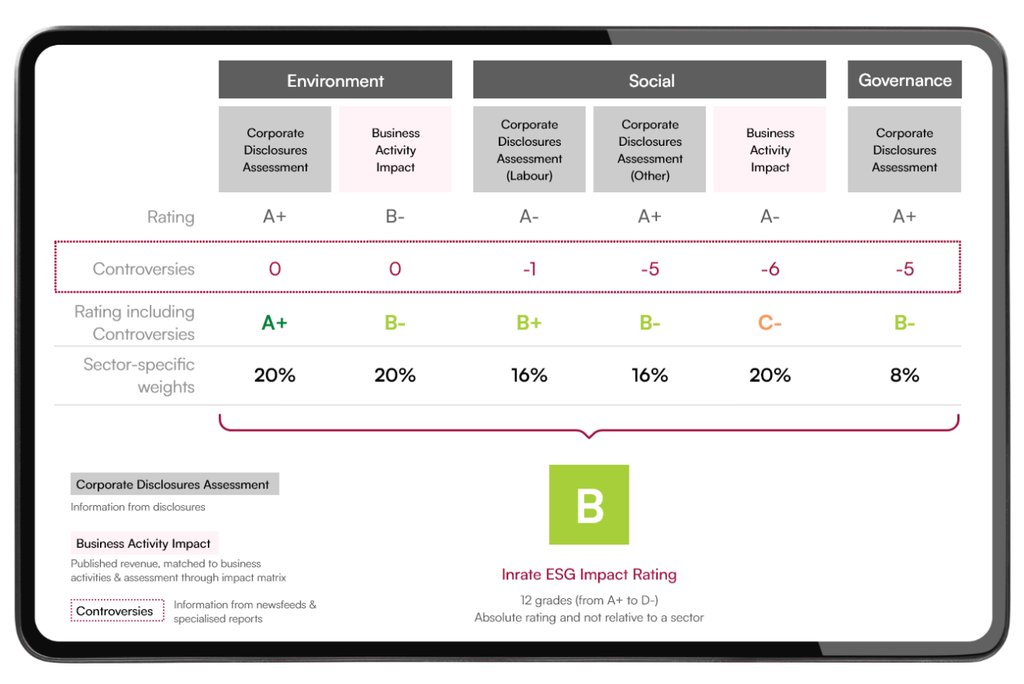

INFRAS worked with the ESG rating agency Inrate to develop their key product the ESG Impact Rating, and is still responsible for its methodology. It differs significantly from conventional ESG ratings, in its innovation and a focus on the impact that corporate activities have on the environment and society.

INFRAS worked with the Swiss pension fund NEST to lay the foundations for the ESG Impact rating – and thus for Inrate itself as a company from 2001. INFRAS still provides Inrate’s research team and therefore has ongoing responsibilities that include the methodology used for the rating and other products.

Evaluating impact rather than risks

As the name suggests, the ESG Impact Rating focuses on a company’s impact on sustainable development. The vast majority of ESG ratings on the market, on the other hand, focus on the risks (and opportunities) that companies face as a result of environmental and societal change. Examples of this include the risk of companies suffering storm damage to their property or of declining biodiversity causing harvest losses.

ESG Impact Rating differs from other ratings

INFRAS helped to develop three innovative aspects for the rating that are still unique in this form today. These three aspects form a vital conceptual basis for the ESG Impact Rating and are detailed below. At a glance, they include:

- Evaluating companies’ products and services throughout the entire value chain, as well as their impact on the environment and society;

- Assessing sustainability using the economic concept of externalities, i.e. of the costs and benefits of activities not borne by the polluters themselves;

- Classifying companies and their activities into service sectors in order enable comparison between companies providing the same service to society.

The ESG Impact Rating is Inrate’s flagship product, and with more than 10,000 companies assessed covers over 99 percent of the entire market capitalisation for listed companies across the globe, as well as over 200 countries and subnational units. Furthermore, INFRAS has also developed Impact Ratings for Inrate to cover a range of other asset classes such as real estate, green bonds and unlisted companies (more information here).

Impact of economic activities systematically incorporated

Many ESG ratings focus on purely evaluating a company’s CSR (corporate social responsibility) activities. Often, far too little consideration is given to the impact that companies’ economic activities (especially their products and services) have on the environment and society throughout their entire value chain. The ESG Impact Rating fills this gap with a sophisticated approach. For example, although an electric car’s impact on climate is more positive than that of a car with a combustion engine, both vehicles cause environmental pollution through tyre wear.

External costs and benefits sharpen the focus on sustainability

The economic concept of externalities has enabled INFRAS to create a conceptual foundation for determining impact. This allows positive and negative contributions to sustainable development to be clearly defined. Within this, companies’ impact is primarily determined via the external costs and benefits they create (costs and benefits for which they do not feel the financial implications). This also allows impact to be compared between completely different areas.

Service sectors: how to compare apples and oranges

For the most part, other ratings compare companies within their narrowly defined industry sectors. Consequently, in each industry, the whole range of rating outcomes is possible. For example, this could enable aircraft manufacturers or oil corporations to gain a top rating, as they are only compared to their direct peers. However, this ignores the ability to substitute various technologies and products for others, and thus also the transformation processes required for sustainable development.

This is where the ESG Impact Rating comes in, collating companies into ‘service sectors’. These are sectors that ultimately serve the same societal need, such as the transport of people and goods. This means that an aircraft manufacturer will not be able to gain a top rating, as in many cases there are alternative forms of transport with a smaller footprint. The same applies to oil companies, whose oil can be replaced with renewable energy sources.

Helping to ensure the quality of the ESG Impact Rating

As well as providing conceptual frameworks, INFRAS also conducts vital work to ensure that the rating retains its high quality. The technological and societal developments relating to sustainability are rapidly evolving. Regular studies on the most important sectors and sustainability topics (such as biodiversity) are therefore an essential tool to remain at the cutting edge of methodology.

The INFRAS team is also involved in performing quality checks on the most relevant companies. In addition, it assists Inrate’s various departments with methodological and content-related questions.

More information:

Further information about INFRAS’s work on the ESG Impact Rating:

- Methodology and product development for the rating agency Inrate

- Making biodiversity measurable: integration into the ESG Impact Rating

In addition to working for Inrate, INFRAS also conducts research and provides consultation for other partners on issues relating to impact, sustainability data and ESG ratings, as well as other topics in the field of sustainable finance and ESG. A selection of our projects: